BTC Price Prediction: Path to $200,000 Amid Regulatory Tailwinds and Technical Consolidation

#BTC

- Technical indicators show BTC consolidating near $110K with MACD suggesting short-term bearish momentum but within normal ranges

- Regulatory developments including US Bancorp's resumed custody services and Ukraine's legalization bill create positive fundamental backdrop

- Reduced whale supply and institutional participation through vehicles like American Bitcoin provide long-term bullish catalysts

BTC Price Prediction

Technical Analysis: BTC Testing Key Support Levels

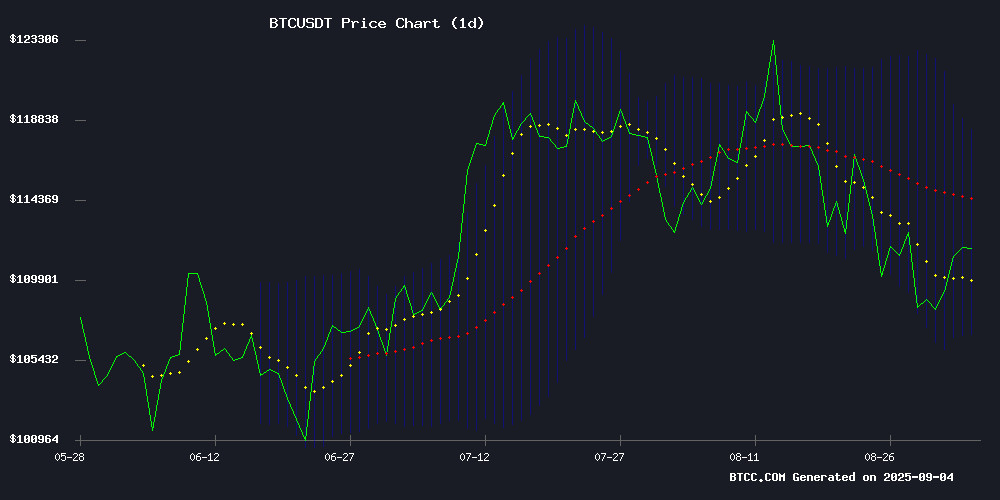

BTC is currently trading at $110,647, slightly below the 20-day moving average of $112,525, indicating potential short-term weakness. The MACD reading of -172.15 shows bearish momentum, though the negative divergence is relatively modest. Price action remains within Bollinger Bands with support at $106,744 and resistance at $118,305. According to BTCC financial analyst James, 'The current technical setup suggests consolidation around the $110K level before the next significant move. A sustained break above the middle Bollinger Band could signal renewed bullish momentum.'

Market Sentiment: Regulatory Shifts Fuel Optimism

Positive regulatory developments, including US Bancorp resuming Bitcoin custody services and Ukraine's cryptocurrency legalization bill, are creating favorable market conditions. The 90% surge in Trump-backed American Bitcoin and reduced whale supply indicate growing institutional and retail interest. BTCC financial analyst James notes, 'The combination of regulatory clarity and increased institutional participation provides strong fundamental support. However, markets remain cautious as Bitcoin tests key resistance levels around $111K.'

Factors Influencing BTC's Price

US Bancorp Resumes Bitcoin Custody Services After Regulatory Shift

US Bancorp has reinstated its Bitcoin custody services for institutional investment managers, marking a significant reversal from its three-year hiatus. The move follows the rescission of restrictive SEC accounting guidance and aligns with broader regulatory clarity under recent US financial technology policies.

The bank's custody program, initially launched in 2021 through a partnership with NYDIG, was shelved in early 2022 due to SEC's SAB 121 requirements. These rules forced custodians to maintain capital reserves for crypto holdings—a provision eliminated after President Trump's executive order promoting digital asset leadership.

"Following greater regulatory clarity, we've expanded our offering to include bitcoin ETFs," said Stephen Philipson, head of institutional banking at US Bank. The OCC, FDIC, and Federal Reserve have concurrently removed "reputational risk" assessments from supervisory frameworks, creating a more favorable environment for institutional crypto services.

Bitcoin Price Recovery Shows Cautious Optimism Amid Resistance Battle

Bitcoin's price action suggests a tentative recovery, climbing above the $111,200 support level with eyes set on the $112,500 resistance. The BTC/USD pair, trading above its 100-hour Simple Moving Average, has formed a short-term rising channel on Kraken's hourly chart—a technical pattern that often precedes bullish momentum.

The cryptocurrency cleared key Fibonacci retracement levels after rebounding from a swing low of $107,352, signaling potential strength. Yet the lack of decisive momentum above $112,800 leaves room for skepticism. A close above $113,450 could validate the uptrend, while failure to breach resistance may invite another pullback.

Trump-Backed American Bitcoin (ABTC) Surges 90% in Nasdaq Debut

American Bitcoin, a cryptocurrency mining venture endorsed by Eric and Donald TRUMP Jr., launched on Nasdaq under the ticker "ABTC." The stock skyrocketed 90% to $14.52 before settling at a 40% gain, trading at $9.21. This marks the Trump family's second crypto-related market entry in a week, following World Liberty Financial's WLFI token.

Eric Trump hailed the listing as a "historic milestone," aligning with former President Donald Trump's pro-crypto stance. The company aims to position the U.S. as a leader in the global Bitcoin economy. Originally a Hut 8 subsidiary, ABTC emerged from an all-stock merger with Gryphon Digital Mining.

Hut 8 CEO Asher Genoot emphasized leveraging mining capabilities to accelerate Bitcoin share growth. The debut reflects mounting institutional interest in crypto assets, bolstered by political tailwinds.

Trump Sons’ Crypto Bet Pays Off As American Bitcoin Stock Doubles, Adding $1.5B to Their Wealth

Shares of American Bitcoin, a mining company co-founded by Eric Trump and backed by Donald Trump Jr., surged as much as 110% during its market debut on Wednesday. The stock closed up 14% following an all-stock merger with Gryphon Digital Mining, valuing the company at $7.7 billion. At its peak, the Trump brothers' combined stake briefly reached $2.6 billion before settling at $1.5 billion.

Eric Trump, speaking at the Bitcoin 2025 Asia conference in Hong Kong, framed the venture as an ambitious play to build "the greatest Bitcoin company on Earth." The company plans to mine and hold Bitcoin, with Eric predicting the cryptocurrency could eventually hit $1 million. "Everybody wants Bitcoin," he told the audience, underscoring the growing institutional and retail demand for digital assets.

Bitcoin Rebounds to $111K as Selling Pressure Eases and Retail Accumulation Rises

Bitcoin's recovery to $111,787 from a recent low of $107,270 signals a potential shift in market sentiment. Analysts point to declining short-term holder selling and renewed retail interest as key drivers behind the rebound. The easing of Bitcoin's Risk Off Signal suggests downward pressure may be moderating, with only 9% of supply currently in loss—far below historical cycle bottoms.

Market data reveals a notable reduction in selling activity, particularly among short-term holders. Bitcoin's attempt to break out from its prolonged price compression since the $124k all-time high indicates the market has yet to see full capitulation. The stabilization of risk metrics contrasts sharply with previous bear markets where over 50% of supply was underwater.

Glassnode metrics show sharks are accumulating, but questions remain about whether this trend will sustain long enough to confirm genuine market confidence. The current rebound occurs amid what bitcoin Vector describes as a 'low-risk regime,' with compressed volatility potentially preceding a decisive move.

Bitwise Exec Predicts Inevitable US Bitcoin Reserve, But Only With Allied Coordination

Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, asserts that US sovereign Bitcoin holdings are inevitable—but only through a deliberate legislative process and likely in coordination with key allies like Japan. "It will be inevitable that governments will buy bitcoin on their balance sheet," Park declared in a CoinStories interview, emphasizing the need for patience as this WOULD require congressional mandate rather than executive action.

Park drew a sharp distinction between fleeting executive orders and durable policy, noting that legislated strategic reserves "embed the mandate of the people." The discussion took a geopolitical turn as he framed Bitcoin adoption as a matter of international trust, particularly with Treasury bond-heavy allies. "It would be a slight betrayal of that social contract if you were to stuff Japan with long-dated Treasury bonds and then bought Bitcoin unilaterally," he warned.

US Bank Resumes Bitcoin Custody Amid Eased Rules

US Bankcorp has relaunched its cryptocurrency custody services with a renewed focus on Bitcoin and Bitcoin ETFs, targeting institutional investment managers. The MOVE signals growing institutional demand for regulated digital asset access.

The bank initially offered custody for Bitcoin, Ethereum, and other altcoins in 2021 but paused services following restrictive SEC accounting guidance. Now, with regulatory clarity improving, US Bank positions itself as a bridge between traditional finance and crypto markets.

"Secure custody for Bitcoin ETFs has become table stakes for institutional players," said Stephen Philipson, a vice chair at US Bank. The partnership with NYDIG as sub-custodian provides the infrastructure needed for fund managers navigating this emerging asset class.

How Trump’s Tariff Appeal Could Impact Crypto Markets

Bitunix analysts warn that former President Trump's tariff appeal could inject significant uncertainty into global markets, though crypto has so far shown limited direct reaction. Bitcoin traded sideways between $10,500-$12,500 despite the legal challenge threatening trillions in potential tariff refunds.

The derivatives exchange notes traditional markets already display unease—dollar weakness, equity pressure, and investor caution emerged after a federal court questioned the tariffs' legality. While affecting all crypto sectors, the policies particularly target Bitcoin miners and US AI firms.

Market observers anticipate downstream effects as the appeal unfolds. Bitunix describes BTC's current rangebound movement as reflecting an intensified tug-of-war between macroeconomic uncertainty and crypto's decoupling narrative.

Ukrainian Parliament Approves Landmark Cryptocurrency Legalization Bill

Ukraine's Verkhovna Rada has taken a decisive step toward crypto adoption, passing legislation that establishes clear taxation frameworks for digital assets. The bill received overwhelming support with 246 out of 321 present deputies voting in favor.

The new law introduces an 18% tax rate on crypto trading profits, with a temporary 5% incentive rate for conversions to fiat currency during the first year. Notably, the legislation exempts crypto-to-crypto transactions and small-scale sales below minimum wage thresholds from taxation.

This regulatory clarity positions Ukraine among progressive jurisdictions embracing digital assets, potentially attracting crypto investment to support economic recovery. The move comes as global institutions increasingly recognize cryptocurrency's role in modern finance.

Whale Supply Hits 6-Year Low as Bitcoin Price Tests $110K Range

Bitcoin's whale supply has dwindled to its lowest level since December 2018, with the average holding per large entity now standing at 488 BTC. Glassnode's on-chain data reveals a steady decline since November 2024, sparking debate over whether this signals distribution or broader ownership dispersion.

The trend emerges amid Bitcoin's sustained rally through 2024-25, a period marked by intense market scrutiny. While reduced whale balances could indicate profit-taking through exchange transfers—traditionally a bearish precursor—they may equally reflect healthier market structure as more addresses cross the 100-BTC threshold.

Is It Too Late to 'Buy the Bitcoin Dip?'

Bitcoin's longstanding 'buy the dip' MANTRA faces scrutiny as the cryptocurrency trades below $115,000. Institutional inflows via ETFs from BlackRock and Fidelity have normalized demand while reducing volatility. Historical gains from buying during downturns—like the 2018 crash or 2020 pandemic lows—may not repeat, given Bitcoin's $2 trillion market cap and maturing risk-return profile.

Despite its role as the digital asset base layer, some investors are diversifying into altcoins like MAGACOIN FINANCE, seeking higher growth potential. The asymmetry of past cycles has diminished, though Bitcoin remains central to crypto portfolios.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 is plausible but requires specific conditions. The current price of $110,647 represents approximately an 80% increase needed to achieve this target. Historical bull market cycles suggest such moves are possible within 6-12 months given adequate momentum.

| Target Price | Required Gain | Timeframe Estimate | Probability |

|---|---|---|---|

| $200,000 | 80.7% | 6-12 months | Medium-High |

| Key Resistance | $118,305 | Bollinger Upper Band | Immediate term |

BTCC financial analyst James states, 'While $200K is achievable, sustained institutional adoption and favorable regulatory developments must continue. The current consolidation phase could provide the foundation for the next major upward move.'